If you intend to let out your former home long-term — or if you’re buying a buy-to-let property — you’ll need to get a buy-to-let mortgage. Coined as a world first by Britain in 1996, these loans are based on what your property would let for, instead of – as for residential mortgages – what you earn.

Fees can be steep (£12,000, anyone?); rates and deposits are higher than for residential homes. On the upside, most are interest-only, which keeps your monthly repayments down.

What is loan-to-value? And equity?

Before we get to how much, a quick refresh on two crucial concepts in the mortgage world (forgive us if you know this):

Loan-to-value (LTV). Always shown as a percentage, this is the amount you borrow (the loan) as a proportion of the property’s value. If you put down a 15% deposit, the loan-to- value will be 85%.

Equity. This is how much you’d get if you sold your home and repaid the mortgage. It includes your deposit, capital you’ve repaid and any gains in price. If your 85% loan-to- value home, bought for £100,000, doubles in value, your equity will be £115,000 or 57.5%.

What is the most you can borrow?

For most buy-to- let loans, lenders require both:

75% loan-to- value. You need a deposit or equity of at least 25%. Though you might find the odd deal if you have only 15% or 20%, those rates will be extortionate

125%-145% rental cover. Depending on the lender, the rent has to be at least 125%-145% more than your monthly mortgage payment calculated at a fictional higher interest rate, typically 5%-6%. Rules are tightening in the wake of the Brexit vote.

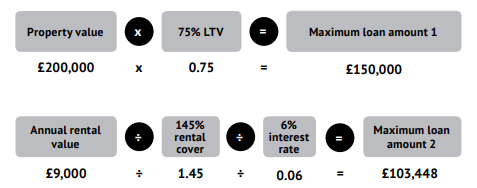

How do you work out the maximum amount you can borrow? Here’s a handy guide, based on the two requirements above:

Buy-to-let mortgage providers will lend you the lower amount of these two calculations, as long as you, your property and your target tenants fit their criteria.

The plot thickens, though, for accidental landlords. If you have lived in your property or inherited it and now want to rent it out, under European Union rules lenders have to treat your mortgage as ‘consumer buy-to-let’ (as opposed to ‘business buy-to-let’ bought for investment purposes). Some will look at your earnings, and if you are older, you could struggle to get a loan. Generally, you may have less choice and end up paying a high rate. Of course, this may all change post Brexit.

What if the lender ‘down-values’?

Whether you are switching from a residential loan or applying for a buy-to- let mortgage on a new purchase, the process is the same. The bank will value both the property itself and its rental potential. If its surveyor thinks you want to borrow too much (or he was slapped with a parking ticket that morning), he could ‘down-value’ either of these – in which case you can appeal to the lender with comparable selling prices or agreed lets in the area.

If the lender won’t budge, you as an accidental landlord would have no choice but to put in more of your own money or sell up. And if you’re buying? You can cough up the shortfall, try to get the seller to lower their price or walk away altogether.

Free emigration guide

Home, work, family, lifestyle, money… 33 things you must know before moving abroad — with advice from cross-border experts and Londoners living overseas

Rental advice + book

How much rent can you get? Should you repaint? Which furniture should stay? We answer all your questions at your home — and give you our bestselling book